Congratulations on your engagement and welcome to a very exciting phase of your life. Today I’ll be sharing my step-by-step guide to setting your wedding budget. I can’t wait to help you plan a stress free wedding. If you haven’t already done so, I’d recommend you have a quick read through our 10 things to do as soon as you get engaged of which setting your wedding budget will be very high on your to do list.

1. Start Working On Your Wedding Budget As Soon As Possible

While it may be tempting to plan your wedding on a pay-as-you-go whim, by doing so you run the risk of depleting your funds before you’ve secured all of the wedding suppliers you want and need to achieve you wedding day goals.

2. Manage Your Wedding Budget In A Spreadsheet

With more than 15 years experience managing multi-million pound budgets, I’d always recommend you start planning any budget with a good spreadsheet! However, I know my eagerness to get number crunching will not be shared by all. So, to get yourself off to a good start, I recommend you contact me to request our easy to use Excel wedding budget template, Designed with couples in mind, it’s the best way to keep all of your information together in an easy-to-scan format. Plus, I’ve pre-populated expenditure headings and formulas (with COVID-19 in mind) to help you apportion your budget with ease and make your money go further.

3. Don’t Be Embarrassed To Ask For Help Setting Your Wedding Budget

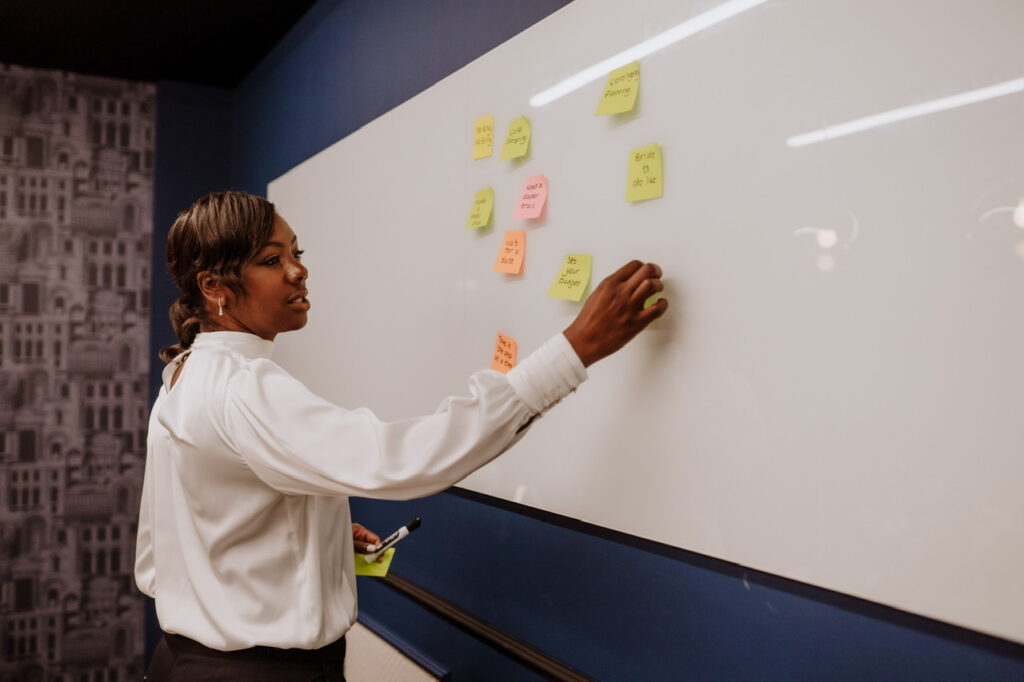

If the thought of talking figures or using an Excel spreadsheet is worrying you, don’t put it off! You could always join one of our wedding budget workshops or arrange a one-to-one wedding planning power hour with me. Just remember, I’m always at the end of the phone if you need a helping hand.

4. Decide If You’ll Use Your Savings To Set Your Wedding Budget

My husband and I found using savings to pay for our wedding would be the most affordable option. As a result, we were able to avoid paying interest and fees associated with borrowing money. Don’t worry if you don’t already have money set aside or if your existing savings are earmarked for something else. You can always open-up a new savings account that’s exclusively dedicated to your wedding. The sooner you can start saving the more you can set aside. Plus this will allow you more time to research venues and services.

Don’t feel pressured into adopting the 50:50: rule. Instead work out the amount you can both comfortably afford to save each month without compromising your quality of life. It’s a good idea to set yourselves a deadline too, otherwise you could be saving for too long and risk loosing wedding planning momentum. I’d recommend you cap your savings target at 24 months, 36 months max!

5. Decide If It’s Worth Using A Bank Loan To Bump-up Your Wedding Budget

If you can’t save enough to cover the full cost of your wedding day, taking out a personal loan could be your best alternative. Although this is not the cheapest option, it will allow you time to repay your wedding tab in fixed monthly instalments over a set number of years. That way, you’ll be able to apportion your budget accordingly, and know exactly what’s owed, thus reducing the risk of overcommitting yourselves.

6. Consider Using A Credit Card As An Extra Layer Of Security

My wedding costs are still very fresh to mind. Given the many varied costs associated with planning a wedding in the UK, there can be some advantages to using a credit card. Many UK credit cards offer purchase protection, so you may be able to get your money back if something goes wrong. Depending on the card, this could include protection in the event of defaults or cancellations. If you’re considering using your credit card towards some of your wedding costs, you need to decide whether you’ll repay the spending immediately or over a longer period of time.

7. Think Carefully Before Accepting Contributions From Family And Friends

Traditionally, the family of the bride would pay for the entire wedding, but times have changed. The majority of my clients usually cover some or all of their wedding expenses. If you are a couple already living together when you marry, your friends & family may present you with cash gifts in lieu of more traditional gifts, that could also help pay for your big day. Be sure to plug these figures into our excel budgeting template if that’s the case for you.

If your relatives are insistent on contributing a lump sum to your wedding day, try to have an open and honest conversation about their expectations. Where many relatives are happy to consider their contribution as a gift and let you spend it as you wish. Some relatives may automatically assume that they have a stake in your big day! Just remember, regardless of the amount, your relatives will deem their contribution as an investment – and it’s likely they’ll want to see a return.

8. Allocate Your Wedding Budget

Before you begin allocating your budget, I recommend you ring-fence 15% as a contingency, 20% if planning during COVID-19.

All you have to do now is allocate your budget. Easier said then done right? By far this will be one of the more challenging tasks on your wedding planning to do list. You could always use our wedding planning budget template and go it alone. Chances are you’ve never planned an event on this scale before, so not sure how much things costs. This is when our wedding planning budget template or wedding planning power hours could come in handy, as a laidback luxury wedding planner, I know exactly how to apportion your wedding budget to make your money go further and deliver the wedding your hoping for.

Boutique soirée, simple but stylish, grand and lavish… whatever you’re dreaming of, we’ll make it come true.

I do hope you’ve enjoyed reading my blog. Please do feel free to connect with me on anyone of our social media channels. YouTube Facebook LinkedIn Twitter Instagram Pinterest

Written by Marsha Mollineau, East London Wedding Planner & Founder of Mollineau Weddings & Events